Using AI-powered Enterprise Interfaces to Optimize Efficiency

Using AI-powered Enterprise Interfaces to Optimize Efficiency

Reducing unnecessary expenses is a direct way to improve cash flow.

Reducing unnecessary expenses is a direct way to improve cash flow.

Diversifying Revenue Streams

Relying on a single source of income can be risky, especially during economic downturns. Expanding your revenue streams can create a more stable cash flow.

Introduce new products or services that complement your existing offerings.

Explore new markets or customer segments to expand your reach.

Implement subscription-based models for predictable recurring revenue.

Diversification not only increases your revenue but also provides financial resilience in uncertain times.

Building an Emergency Cash Reserve

Unexpected expenses or revenue dips can disrupt your business. Having a financial cushion ensures you can cover essential costs without relying on credit.

Set aside a portion of your profits into a dedicated cash reserve.

Keep the reserve in easily accessible accounts for quick withdrawals.

Replenish your emergency fund consistently to maintain stability.

This proactive approach prevents cash flow crises and gives you greater financial confidence.

Leveraging Technology for Cash Flow Management

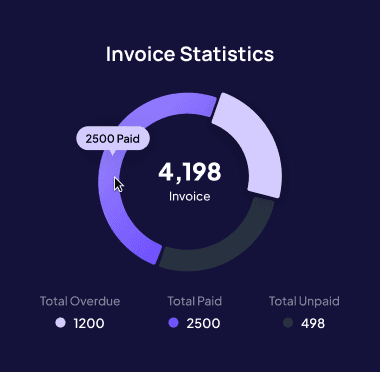

Modern technology can streamline cash flow management, giving you real-time insights and automation tools.

Use cloud-based accounting software for up-to-date cash flow tracking.

Automate invoicing and payment processing to reduce delays.

Monitor key performance indicators (KPIs) to identify potential issues early.

By utilizing digital solutions, you can manage your finances efficiently and make data-driven decisions to improve cash flow.

Reducing Debt and Interest Costs

Excessive debt can drain your cash flow due to high interest payments. Managing your liabilities wisely can help free up funds for operational needs.

Prioritize repaying high-interest debts first to reduce financial strain.

Consider refinancing loans to secure better terms and lower interest rates.

Avoid over-reliance on credit for daily business operations.

A well-managed debt strategy ensures that more of your revenue remains available for growth rather than being consumed by repayments.

Diversifying Revenue Streams

Relying on a single source of income can be risky, especially during economic downturns. Expanding your revenue streams can create a more stable cash flow.

Introduce new products or services that complement your existing offerings.

Explore new markets or customer segments to expand your reach.

Implement subscription-based models for predictable recurring revenue.

Diversification not only increases your revenue but also provides financial resilience in uncertain times.

Building an Emergency Cash Reserve

Unexpected expenses or revenue dips can disrupt your business. Having a financial cushion ensures you can cover essential costs without relying on credit.

Set aside a portion of your profits into a dedicated cash reserve.

Keep the reserve in easily accessible accounts for quick withdrawals.

Replenish your emergency fund consistently to maintain stability.

This proactive approach prevents cash flow crises and gives you greater financial confidence.

Leveraging Technology for Cash Flow Management

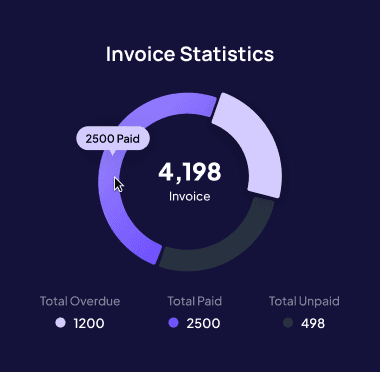

Modern technology can streamline cash flow management, giving you real-time insights and automation tools.

Use cloud-based accounting software for up-to-date cash flow tracking.

Automate invoicing and payment processing to reduce delays.

Monitor key performance indicators (KPIs) to identify potential issues early.

By utilizing digital solutions, you can manage your finances efficiently and make data-driven decisions to improve cash flow.

Reducing Debt and Interest Costs

Excessive debt can drain your cash flow due to high interest payments. Managing your liabilities wisely can help free up funds for operational needs.

Prioritize repaying high-interest debts first to reduce financial strain.

Consider refinancing loans to secure better terms and lower interest rates.

Avoid over-reliance on credit for daily business operations.

A well-managed debt strategy ensures that more of your revenue remains available for growth rather than being consumed by repayments.

Diversifying Revenue Streams

Relying on a single source of income can be risky, especially during economic downturns. Expanding your revenue streams can create a more stable cash flow.

Introduce new products or services that complement your existing offerings.

Explore new markets or customer segments to expand your reach.

Implement subscription-based models for predictable recurring revenue.

Diversification not only increases your revenue but also provides financial resilience in uncertain times.

Building an Emergency Cash Reserve

Unexpected expenses or revenue dips can disrupt your business. Having a financial cushion ensures you can cover essential costs without relying on credit.

Set aside a portion of your profits into a dedicated cash reserve.

Keep the reserve in easily accessible accounts for quick withdrawals.

Replenish your emergency fund consistently to maintain stability.

This proactive approach prevents cash flow crises and gives you greater financial confidence.

Leveraging Technology for Cash Flow Management

Modern technology can streamline cash flow management, giving you real-time insights and automation tools.

Use cloud-based accounting software for up-to-date cash flow tracking.

Automate invoicing and payment processing to reduce delays.

Monitor key performance indicators (KPIs) to identify potential issues early.

By utilizing digital solutions, you can manage your finances efficiently and make data-driven decisions to improve cash flow.

Reducing Debt and Interest Costs

Excessive debt can drain your cash flow due to high interest payments. Managing your liabilities wisely can help free up funds for operational needs.

Prioritize repaying high-interest debts first to reduce financial strain.

Consider refinancing loans to secure better terms and lower interest rates.

Avoid over-reliance on credit for daily business operations.

A well-managed debt strategy ensures that more of your revenue remains available for growth rather than being consumed by repayments.

Recent Posts

Recent Posts

Recent Posts

Similar Blog You May Like

Similar Blog You May Like

Similar Blog You May Like

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.