Why Cash Flow is King: Essential Tips for Business Owners

Why Cash Flow is King: Essential Tips for Business Owners

Many suppliers are open to longer payment cycles if you have a strong relationship.

Many suppliers are open to longer payment cycles if you have a strong relationship.

Forecasting Cash Flow

Accurate cash flow forecasting is crucial for financial planning. Without it, businesses risk running into liquidity problems that can lead to operational disruptions or even bankruptcy.

To create a reliable forecast:

Use historical data: Review past cash inflows and outflows to predict future trends.

Identify seasonal trends: Many businesses experience fluctuations due to seasonality. Plan accordingly.

Update forecasts regularly: Market conditions and customer behavior can change, so refine projections monthly or quarterly.

A well-maintained cash flow forecast helps you anticipate shortfalls and surpluses, allowing you to adjust spending or take advantage of investment opportunities.

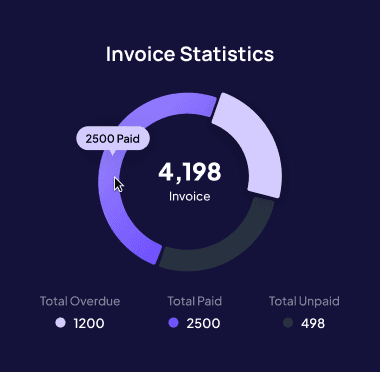

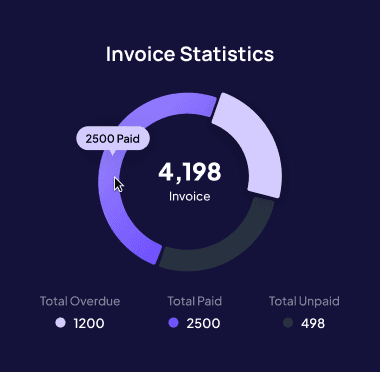

Managing Accounts Receivable Efficiently

Late payments from customers can cause significant cash flow challenges. To keep your cash flow healthy, implement strategies that encourage prompt payments.

Establish clear payment terms: Define due dates, late fees, and interest penalties upfront.

Offer early payment incentives: Providing discounts for early payments can accelerate cash inflows.

Automate invoicing and reminders: Use accounting software to send automatic payment reminders to customers.

Follow up promptly on overdue invoices: Implement a structured collection process to avoid long-standing receivables.

By improving your accounts receivable management, you ensure a steady stream of incoming cash and minimize the risk of cash shortages.

Optimizing Operating Expenses

Cutting unnecessary costs is a direct way to improve cash flow. Many businesses lose money through inefficient spending without realizing it.

Conduct regular expense audits: Analyze monthly expenses and identify non-essential costs.

Negotiate lower costs with suppliers and vendors: If you’ve been a long-term customer, request better pricing.

Reduce energy and utility costs: Simple changes like energy-efficient lighting and equipment can save money.

Streamline staffing costs: If necessary, use part-time or contract employees to adjust labor costs based on demand.

By keeping expenses lean, your business can operate more efficiently and preserve cash for strategic investments.

Monitor and Adjust Regularly

Cash flow is the lifeblood of any business. Proper management ensures your company has enough liquidity to cover expenses, invest in growth, and stay financially stable. This complete guide will walk you through key strategies to improve and optimize your business cash flow. Regularly review your inventory to prevent overstocking or understocking. Excess inventory ties up cash that could be better used elsewhere. Ensure your pricing covers all costs while staying competitive. Adjust prices if necessary to protect your margins.

Cash flow is the lifeblood of any business. Proper management ensures your company has enough liquidity to cover expenses, invest in growth, and stay financially stable. This complete guide will walk you through key strategies to improve and optimize your business cash flow. Regularly review your inventory to prevent overstocking or understocking. Excess inventory ties up cash that could be better used elsewhere. Ensure your pricing covers all costs while staying competitive. Adjust prices if necessary to protect your margins.

Forecasting Cash Flow

Accurate cash flow forecasting is crucial for financial planning. Without it, businesses risk running into liquidity problems that can lead to operational disruptions or even bankruptcy.

To create a reliable forecast:

Use historical data: Review past cash inflows and outflows to predict future trends.

Identify seasonal trends: Many businesses experience fluctuations due to seasonality. Plan accordingly.

Update forecasts regularly: Market conditions and customer behavior can change, so refine projections monthly or quarterly.

A well-maintained cash flow forecast helps you anticipate shortfalls and surpluses, allowing you to adjust spending or take advantage of investment opportunities.

Managing Accounts Receivable Efficiently

Late payments from customers can cause significant cash flow challenges. To keep your cash flow healthy, implement strategies that encourage prompt payments.

Establish clear payment terms: Define due dates, late fees, and interest penalties upfront.

Offer early payment incentives: Providing discounts for early payments can accelerate cash inflows.

Automate invoicing and reminders: Use accounting software to send automatic payment reminders to customers.

Follow up promptly on overdue invoices: Implement a structured collection process to avoid long-standing receivables.

By improving your accounts receivable management, you ensure a steady stream of incoming cash and minimize the risk of cash shortages.

Optimizing Operating Expenses

Cutting unnecessary costs is a direct way to improve cash flow. Many businesses lose money through inefficient spending without realizing it.

Conduct regular expense audits: Analyze monthly expenses and identify non-essential costs.

Negotiate lower costs with suppliers and vendors: If you’ve been a long-term customer, request better pricing.

Reduce energy and utility costs: Simple changes like energy-efficient lighting and equipment can save money.

Streamline staffing costs: If necessary, use part-time or contract employees to adjust labor costs based on demand.

By keeping expenses lean, your business can operate more efficiently and preserve cash for strategic investments.

Monitor and Adjust Regularly

Cash flow is the lifeblood of any business. Proper management ensures your company has enough liquidity to cover expenses, invest in growth, and stay financially stable. This complete guide will walk you through key strategies to improve and optimize your business cash flow. Regularly review your inventory to prevent overstocking or understocking. Excess inventory ties up cash that could be better used elsewhere. Ensure your pricing covers all costs while staying competitive. Adjust prices if necessary to protect your margins.

Cash flow is the lifeblood of any business. Proper management ensures your company has enough liquidity to cover expenses, invest in growth, and stay financially stable. This complete guide will walk you through key strategies to improve and optimize your business cash flow. Regularly review your inventory to prevent overstocking or understocking. Excess inventory ties up cash that could be better used elsewhere. Ensure your pricing covers all costs while staying competitive. Adjust prices if necessary to protect your margins.

Recent Posts

Recent Posts

Similar Blog You May Like

Similar Blog You May Like

Similar Blog You May Like

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.