Top Investment Strategies for Beginners

Top Investment Strategies for Beginners

In a downturn, expect slower sales and adjust your expectations accordingly.

In a downturn, expect slower sales and adjust your expectations accordingly.

Monitor and Forecast Cash Flow Regularly

One of the biggest mistakes businesses make during downturns is failing to plan ahead. Without an accurate cash flow forecast, you may not realize you’re heading toward a cash shortage until it’s too late.

Track cash inflows and outflows weekly or monthly. Keeping a close eye on your financials helps you spot trends early.

Use conservative revenue projections. In a downturn, expect slower sales and adjust your expectations accordingly.

Prepare multiple cash flow scenarios. Consider best-case, worst-case, and moderate situations to plan accordingly.

By forecasting your cash flow, you can anticipate potential gaps and take early action to prevent financial distress.

Cut Non-Essential Expenses

When sales slow down, reducing costs is one of the fastest ways to improve cash flow. However, cutting expenses recklessly can hurt operations and customer satisfaction. Instead, focus on strategic cost reductions.

Eliminate unnecessary subscriptions and services. Review monthly expenses and cancel anything that doesn’t directly contribute to revenue or efficiency.

Negotiate with vendors and suppliers. Ask for discounts, extended payment terms, or better deals. Many suppliers are willing to be flexible during downturns.

Reduce discretionary spending. This includes business travel, office perks, and non-essential marketing expenses.

The goal is to trim waste without disrupting the core functions of your business.

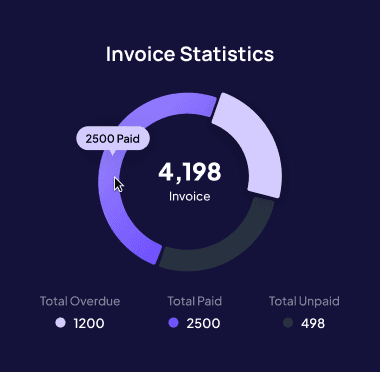

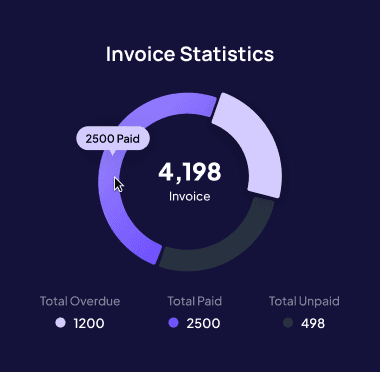

Speed Up Receivables and Encourage Faster Payments

Slow-paying customers can create cash flow problems, especially when your business needs funds quickly. Instead of waiting for payments, take proactive steps to accelerate receivables.

Send invoices promptly. Delays in invoicing lead to delays in payment. Automate the process if possible.

Offer early payment discounts. A small discount (e.g., 2% off for payments within 10 days) can encourage customers to pay faster.

Enforce payment terms. Set clear payment deadlines and follow up promptly on overdue invoices. Use automated reminders to nudge late payers.

If cash flow is tight, consider invoice factoring, where you sell unpaid invoices to a third party for immediate cash.

Delay Payables Without Damaging Relationships

Just as you want to get paid faster, you should also extend your own payment deadlines whenever possible. This doesn’t mean defaulting on obligations—it means managing cash flow strategically.

Negotiate extended payment terms. Many suppliers are open to 60- or 90-day terms instead of the usual 30 days.

Prioritize essential payments. Payroll, rent, and critical supplier payments should come first.

Use business credit wisely. If necessary, short-term financing options like business lines of credit can help bridge temporary cash flow gaps.

The key is balancing outgoing payments with incoming cash to maintain liquidity.

Monitor and Forecast Cash Flow Regularly

One of the biggest mistakes businesses make during downturns is failing to plan ahead. Without an accurate cash flow forecast, you may not realize you’re heading toward a cash shortage until it’s too late.

Track cash inflows and outflows weekly or monthly. Keeping a close eye on your financials helps you spot trends early.

Use conservative revenue projections. In a downturn, expect slower sales and adjust your expectations accordingly.

Prepare multiple cash flow scenarios. Consider best-case, worst-case, and moderate situations to plan accordingly.

By forecasting your cash flow, you can anticipate potential gaps and take early action to prevent financial distress.

Cut Non-Essential Expenses

When sales slow down, reducing costs is one of the fastest ways to improve cash flow. However, cutting expenses recklessly can hurt operations and customer satisfaction. Instead, focus on strategic cost reductions.

Eliminate unnecessary subscriptions and services. Review monthly expenses and cancel anything that doesn’t directly contribute to revenue or efficiency.

Negotiate with vendors and suppliers. Ask for discounts, extended payment terms, or better deals. Many suppliers are willing to be flexible during downturns.

Reduce discretionary spending. This includes business travel, office perks, and non-essential marketing expenses.

The goal is to trim waste without disrupting the core functions of your business.

Speed Up Receivables and Encourage Faster Payments

Slow-paying customers can create cash flow problems, especially when your business needs funds quickly. Instead of waiting for payments, take proactive steps to accelerate receivables.

Send invoices promptly. Delays in invoicing lead to delays in payment. Automate the process if possible.

Offer early payment discounts. A small discount (e.g., 2% off for payments within 10 days) can encourage customers to pay faster.

Enforce payment terms. Set clear payment deadlines and follow up promptly on overdue invoices. Use automated reminders to nudge late payers.

If cash flow is tight, consider invoice factoring, where you sell unpaid invoices to a third party for immediate cash.

Delay Payables Without Damaging Relationships

Just as you want to get paid faster, you should also extend your own payment deadlines whenever possible. This doesn’t mean defaulting on obligations—it means managing cash flow strategically.

Negotiate extended payment terms. Many suppliers are open to 60- or 90-day terms instead of the usual 30 days.

Prioritize essential payments. Payroll, rent, and critical supplier payments should come first.

Use business credit wisely. If necessary, short-term financing options like business lines of credit can help bridge temporary cash flow gaps.

The key is balancing outgoing payments with incoming cash to maintain liquidity.

Monitor and Forecast Cash Flow Regularly

One of the biggest mistakes businesses make during downturns is failing to plan ahead. Without an accurate cash flow forecast, you may not realize you’re heading toward a cash shortage until it’s too late.

Track cash inflows and outflows weekly or monthly. Keeping a close eye on your financials helps you spot trends early.

Use conservative revenue projections. In a downturn, expect slower sales and adjust your expectations accordingly.

Prepare multiple cash flow scenarios. Consider best-case, worst-case, and moderate situations to plan accordingly.

By forecasting your cash flow, you can anticipate potential gaps and take early action to prevent financial distress.

Cut Non-Essential Expenses

When sales slow down, reducing costs is one of the fastest ways to improve cash flow. However, cutting expenses recklessly can hurt operations and customer satisfaction. Instead, focus on strategic cost reductions.

Eliminate unnecessary subscriptions and services. Review monthly expenses and cancel anything that doesn’t directly contribute to revenue or efficiency.

Negotiate with vendors and suppliers. Ask for discounts, extended payment terms, or better deals. Many suppliers are willing to be flexible during downturns.

Reduce discretionary spending. This includes business travel, office perks, and non-essential marketing expenses.

The goal is to trim waste without disrupting the core functions of your business.

Speed Up Receivables and Encourage Faster Payments

Slow-paying customers can create cash flow problems, especially when your business needs funds quickly. Instead of waiting for payments, take proactive steps to accelerate receivables.

Send invoices promptly. Delays in invoicing lead to delays in payment. Automate the process if possible.

Offer early payment discounts. A small discount (e.g., 2% off for payments within 10 days) can encourage customers to pay faster.

Enforce payment terms. Set clear payment deadlines and follow up promptly on overdue invoices. Use automated reminders to nudge late payers.

If cash flow is tight, consider invoice factoring, where you sell unpaid invoices to a third party for immediate cash.

Delay Payables Without Damaging Relationships

Just as you want to get paid faster, you should also extend your own payment deadlines whenever possible. This doesn’t mean defaulting on obligations—it means managing cash flow strategically.

Negotiate extended payment terms. Many suppliers are open to 60- or 90-day terms instead of the usual 30 days.

Prioritize essential payments. Payroll, rent, and critical supplier payments should come first.

Use business credit wisely. If necessary, short-term financing options like business lines of credit can help bridge temporary cash flow gaps.

The key is balancing outgoing payments with incoming cash to maintain liquidity.

Recent Posts

Recent Posts

Recent Posts

Similar Blog You May Like

Similar Blog You May Like

Similar Blog You May Like

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.