Tax Planning and Preparing Made Easy for Everyone

Tax Planning and Preparing Made Easy for Everyone

Subscription-based services provide consistent cash flow, even during downturns.

Subscription-based services provide consistent cash flow, even during downturns.

Leverage Technology for Smarter Cash Flow Management

Modern financial tools can help businesses track and manage cash flow more efficiently.

Use cloud-based accounting software like QuickBooks, Xero, or FreshBooks to monitor cash flow in real time.

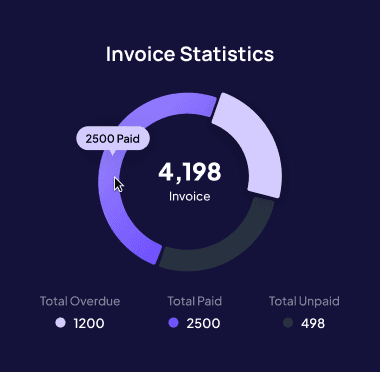

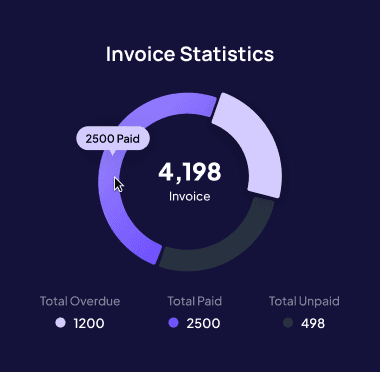

Automate invoices and payment reminders to ensure timely collections.

Analyze cash flow trends using AI-driven financial planning tools. These tools can predict cash shortages before they happen.

Technology makes it easier to manage finances proactively instead of reacting to problems after they arise.

Seek Short-Term Financing If Necessary

If cash flow becomes too tight, short-term financing options can provide temporary relief. However, these should be used cautiously.

Business lines of credit allow you to borrow only what you need and repay when cash flow improves.

Invoice financing lets you get paid for outstanding invoices immediately.

Short-term loans can provide immediate funds, but be mindful of interest rates.

Always compare financing options carefully and choose the one with the lowest cost and most flexible repayment terms.

Optimize Inventory Management

One of the most overlooked aspects of cash flow management is inventory control. Holding too much inventory ties up valuable cash, while too little can lead to missed sales opportunities.

Regularly review inventory levels to avoid overstocking or understocking.

Use demand forecasting tools to predict sales patterns and adjust inventory accordingly.

Liquidate slow-moving stock through promotions or discounts to free up cash.

By keeping inventory lean and aligned with demand, you can improve cash flow while ensuring product availability.

Ensure Profitable Pricing Strategies

Your pricing model plays a crucial role in maintaining healthy cash flow. Prices should not only cover costs but also generate a sustainable profit while remaining competitive.

Regularly analyze profit margins to ensure they align with business goals.

Adjust prices when necessary to reflect changes in costs, inflation, or market conditions.

Offer strategic discounts to boost sales without harming long-term profitability.

A well-structured pricing strategy helps maintain steady cash flow while keeping your business financially viable.

Leverage Technology for Smarter Cash Flow Management

Modern financial tools can help businesses track and manage cash flow more efficiently.

Use cloud-based accounting software like QuickBooks, Xero, or FreshBooks to monitor cash flow in real time.

Automate invoices and payment reminders to ensure timely collections.

Analyze cash flow trends using AI-driven financial planning tools. These tools can predict cash shortages before they happen.

Technology makes it easier to manage finances proactively instead of reacting to problems after they arise.

Seek Short-Term Financing If Necessary

If cash flow becomes too tight, short-term financing options can provide temporary relief. However, these should be used cautiously.

Business lines of credit allow you to borrow only what you need and repay when cash flow improves.

Invoice financing lets you get paid for outstanding invoices immediately.

Short-term loans can provide immediate funds, but be mindful of interest rates.

Always compare financing options carefully and choose the one with the lowest cost and most flexible repayment terms.

Optimize Inventory Management

One of the most overlooked aspects of cash flow management is inventory control. Holding too much inventory ties up valuable cash, while too little can lead to missed sales opportunities.

Regularly review inventory levels to avoid overstocking or understocking.

Use demand forecasting tools to predict sales patterns and adjust inventory accordingly.

Liquidate slow-moving stock through promotions or discounts to free up cash.

By keeping inventory lean and aligned with demand, you can improve cash flow while ensuring product availability.

Ensure Profitable Pricing Strategies

Your pricing model plays a crucial role in maintaining healthy cash flow. Prices should not only cover costs but also generate a sustainable profit while remaining competitive.

Regularly analyze profit margins to ensure they align with business goals.

Adjust prices when necessary to reflect changes in costs, inflation, or market conditions.

Offer strategic discounts to boost sales without harming long-term profitability.

A well-structured pricing strategy helps maintain steady cash flow while keeping your business financially viable.

Leverage Technology for Smarter Cash Flow Management

Modern financial tools can help businesses track and manage cash flow more efficiently.

Use cloud-based accounting software like QuickBooks, Xero, or FreshBooks to monitor cash flow in real time.

Automate invoices and payment reminders to ensure timely collections.

Analyze cash flow trends using AI-driven financial planning tools. These tools can predict cash shortages before they happen.

Technology makes it easier to manage finances proactively instead of reacting to problems after they arise.

Seek Short-Term Financing If Necessary

If cash flow becomes too tight, short-term financing options can provide temporary relief. However, these should be used cautiously.

Business lines of credit allow you to borrow only what you need and repay when cash flow improves.

Invoice financing lets you get paid for outstanding invoices immediately.

Short-term loans can provide immediate funds, but be mindful of interest rates.

Always compare financing options carefully and choose the one with the lowest cost and most flexible repayment terms.

Optimize Inventory Management

One of the most overlooked aspects of cash flow management is inventory control. Holding too much inventory ties up valuable cash, while too little can lead to missed sales opportunities.

Regularly review inventory levels to avoid overstocking or understocking.

Use demand forecasting tools to predict sales patterns and adjust inventory accordingly.

Liquidate slow-moving stock through promotions or discounts to free up cash.

By keeping inventory lean and aligned with demand, you can improve cash flow while ensuring product availability.

Ensure Profitable Pricing Strategies

Your pricing model plays a crucial role in maintaining healthy cash flow. Prices should not only cover costs but also generate a sustainable profit while remaining competitive.

Regularly analyze profit margins to ensure they align with business goals.

Adjust prices when necessary to reflect changes in costs, inflation, or market conditions.

Offer strategic discounts to boost sales without harming long-term profitability.

A well-structured pricing strategy helps maintain steady cash flow while keeping your business financially viable.

Recent Posts

Recent Posts

Recent Posts

Similar Blog You May Like

Similar Blog You May Like

Similar Blog You May Like

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.