How to Prepare Your Business for a Financial Audit: Best Practices

How to Prepare Your Business for a Financial Audit: Best Practices

Diversifying income sources ensures that if one stream slows down, your business continues generating revenue from others.

Diversifying income sources ensures that if one stream slows down, your business continues generating revenue from others.

Utilizing Short-Term Financing

Short-term financing can help businesses manage temporary cash flow gaps. These options provide quick access to funds when needed:

Business lines of credit: A flexible financing option that allows you to borrow as needed.

Invoice financing: Receive an advance on outstanding invoices to maintain cash flow.

Short-term business loans: Quick funding solutions for urgent expenses or opportunities.

Merchant cash advances: Suitable for businesses with high credit card sales but should be used cautiously due to high fees.

Using financing strategically ensures that businesses can cover short-term expenses without depleting cash reserves.

Reducing Debt and Interest Costs

Excessive debt and high interest payments can drain cash flow, limiting your ability to invest in growth. A proactive debt reduction strategy helps maintain financial flexibility.

Prioritize high-interest debt repayments to reduce financial strain.

Refinance loans for lower interest rates if better terms become available.

Consolidate debts to simplify payments and potentially lower interest costs.

Avoid over-reliance on credit for daily operations unless absolutely necessary.

Managing debt wisely ensures that more of your revenue is available for business development rather than being consumed by interest payments.

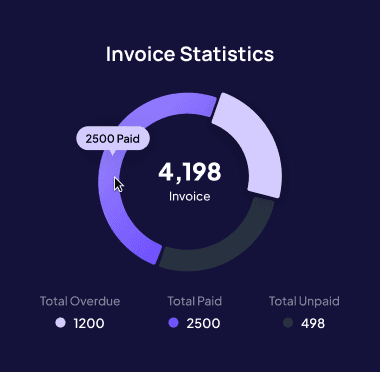

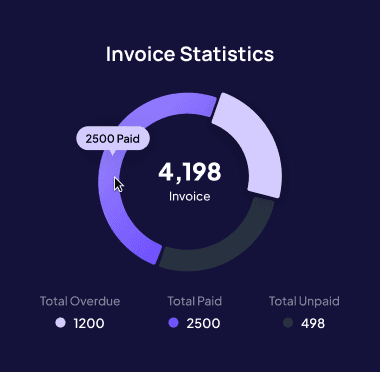

Controlling Accounts Payable

Managing how and when you pay your suppliers can have a significant impact on cash flow. Rather than paying invoices immediately, optimize your accounts payable strategy.

Negotiate extended payment terms: Many suppliers are open to longer payment cycles if you have a strong relationship.

Use just-in-time (JIT) inventory management: This minimizes cash tied up in stock while ensuring you have what you need.

Prioritize essential payments: Rent, payroll, and utilities should take priority over discretionary expenses.

Take advantage of early payment discounts when beneficial: If cash flow allows, paying early can save money in the long run.

By carefully scheduling payments, businesses can maintain liquidity and keep cash available for critical operations.

Optimizing Operating Expenses

Cutting unnecessary costs is a direct way to improve cash flow. Many businesses lose money through inefficient spending without realizing it.

Conduct regular expense audits: Analyze monthly expenses and identify non-essential costs.

Negotiate lower costs with suppliers and vendors: If you’ve been a long-term customer, request better pricing.

Reduce energy and utility costs: Simple changes like energy-efficient lighting and equipment can save money.

Streamline staffing costs: If necessary, use part-time or contract employees to adjust labor costs based on demand.

By keeping expenses lean, your business can operate more efficiently and preserve cash for strategic investments.

Utilizing Short-Term Financing

Short-term financing can help businesses manage temporary cash flow gaps. These options provide quick access to funds when needed:

Business lines of credit: A flexible financing option that allows you to borrow as needed.

Invoice financing: Receive an advance on outstanding invoices to maintain cash flow.

Short-term business loans: Quick funding solutions for urgent expenses or opportunities.

Merchant cash advances: Suitable for businesses with high credit card sales but should be used cautiously due to high fees.

Using financing strategically ensures that businesses can cover short-term expenses without depleting cash reserves.

Reducing Debt and Interest Costs

Excessive debt and high interest payments can drain cash flow, limiting your ability to invest in growth. A proactive debt reduction strategy helps maintain financial flexibility.

Prioritize high-interest debt repayments to reduce financial strain.

Refinance loans for lower interest rates if better terms become available.

Consolidate debts to simplify payments and potentially lower interest costs.

Avoid over-reliance on credit for daily operations unless absolutely necessary.

Managing debt wisely ensures that more of your revenue is available for business development rather than being consumed by interest payments.

Controlling Accounts Payable

Managing how and when you pay your suppliers can have a significant impact on cash flow. Rather than paying invoices immediately, optimize your accounts payable strategy.

Negotiate extended payment terms: Many suppliers are open to longer payment cycles if you have a strong relationship.

Use just-in-time (JIT) inventory management: This minimizes cash tied up in stock while ensuring you have what you need.

Prioritize essential payments: Rent, payroll, and utilities should take priority over discretionary expenses.

Take advantage of early payment discounts when beneficial: If cash flow allows, paying early can save money in the long run.

By carefully scheduling payments, businesses can maintain liquidity and keep cash available for critical operations.

Optimizing Operating Expenses

Cutting unnecessary costs is a direct way to improve cash flow. Many businesses lose money through inefficient spending without realizing it.

Conduct regular expense audits: Analyze monthly expenses and identify non-essential costs.

Negotiate lower costs with suppliers and vendors: If you’ve been a long-term customer, request better pricing.

Reduce energy and utility costs: Simple changes like energy-efficient lighting and equipment can save money.

Streamline staffing costs: If necessary, use part-time or contract employees to adjust labor costs based on demand.

By keeping expenses lean, your business can operate more efficiently and preserve cash for strategic investments.

Utilizing Short-Term Financing

Short-term financing can help businesses manage temporary cash flow gaps. These options provide quick access to funds when needed:

Business lines of credit: A flexible financing option that allows you to borrow as needed.

Invoice financing: Receive an advance on outstanding invoices to maintain cash flow.

Short-term business loans: Quick funding solutions for urgent expenses or opportunities.

Merchant cash advances: Suitable for businesses with high credit card sales but should be used cautiously due to high fees.

Using financing strategically ensures that businesses can cover short-term expenses without depleting cash reserves.

Reducing Debt and Interest Costs

Excessive debt and high interest payments can drain cash flow, limiting your ability to invest in growth. A proactive debt reduction strategy helps maintain financial flexibility.

Prioritize high-interest debt repayments to reduce financial strain.

Refinance loans for lower interest rates if better terms become available.

Consolidate debts to simplify payments and potentially lower interest costs.

Avoid over-reliance on credit for daily operations unless absolutely necessary.

Managing debt wisely ensures that more of your revenue is available for business development rather than being consumed by interest payments.

Controlling Accounts Payable

Managing how and when you pay your suppliers can have a significant impact on cash flow. Rather than paying invoices immediately, optimize your accounts payable strategy.

Negotiate extended payment terms: Many suppliers are open to longer payment cycles if you have a strong relationship.

Use just-in-time (JIT) inventory management: This minimizes cash tied up in stock while ensuring you have what you need.

Prioritize essential payments: Rent, payroll, and utilities should take priority over discretionary expenses.

Take advantage of early payment discounts when beneficial: If cash flow allows, paying early can save money in the long run.

By carefully scheduling payments, businesses can maintain liquidity and keep cash available for critical operations.

Optimizing Operating Expenses

Cutting unnecessary costs is a direct way to improve cash flow. Many businesses lose money through inefficient spending without realizing it.

Conduct regular expense audits: Analyze monthly expenses and identify non-essential costs.

Negotiate lower costs with suppliers and vendors: If you’ve been a long-term customer, request better pricing.

Reduce energy and utility costs: Simple changes like energy-efficient lighting and equipment can save money.

Streamline staffing costs: If necessary, use part-time or contract employees to adjust labor costs based on demand.

By keeping expenses lean, your business can operate more efficiently and preserve cash for strategic investments.

Recent Posts

Recent Posts

Recent Posts

Similar Blog You May Like

Similar Blog You May Like

Similar Blog You May Like

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.

Unlock Your Financial Potential with Automation

Create dynamic budgets with predictive insights and scenario planning to help you manage future cash flows.